OVERVIEW OF PHILIPPINE TAXATION SYSTEM

GLOBAL TAX SYSTEM

Total Gross Income from compensation, business, profession and other income not subject to Final Tax less total Deductions times / exemptions multiplies by applicable rate of tax.

SCHEDULAR TAX SYSTEM

Passive income and Capital Gains on Shares of Stocks and GSP or FMV of Real Properties classified as Capital Asset times applicable Rate of Tax.

The Philippines is on the semi-global or semi schedular tax system. Either one may apply on income of a taxpayer, depending on nature of income.

Taxes are imposed by law (e.g., NIRC)

while financial accounting are based on generally accepted accounting standards.

in case of conflict between tax rules and accounting rules, the former shall prevail.

Source: RMC 22-2004

🔸 Necessity Theory

🔸 Benefit Theory

🔸 Lifeblood Theory

🔸 Domicillary Theory

🔸 Nationality Theory

👉 Necessity Theory

This is a theory that postulates that the existence of government is a necessity and that the same cannot continue without the means for paying for its operations. Thus, for government to continue, it has the right to compel all its citizens and property within its territorial jurisdiction to contribute in defraying the expenses for its continued existence.

👉 Benefit Theory

This theory takes into consideration that citizens are the beneficiaries of an organized society and in exchange for such benefits, it has the obligation to pay for it.

👉 Lifeblood Theory

It has been held, in almost every jurisdiction, that taxes provide the fuel that runs the vehicle of governance. It is the energy and force that animates governmental machinery in order to fully live up to its continuing mandate of providing basic public services to its citizens with the end in view of ensuring the smooth and stable existence of a civilized society. As such, it has been called the "lifeblood" of society, without which would negate the very purpose of government.

👉 Domicillary Theory

This is a conflict of law theory by virtue of which a particular matter affecting a person, such as personal situs, is determined by and/or subject to the jurisdiction of law of his domicile.

👉 Nationality Theory

This is a conflict of laws theory by virtue of which jurisdiction over a particular matter affecting a person such as status of a natural person, is determined by the latter's nationality.

This is a privileged communication. Researched by easantoscpa.com | ptabcp.com.

| Particulars | RR | Dated |

|---|---|---|

| Income Tax | RR 2-1940 | February 10, 1940 |

| Withholding Taxes | RR 2-1998 | April 17, 1998 |

| Value-Added Tax | RR 16-2005 | September 1, 2005 |

| Estate and Donor's Tax | RR 2-2003 | December 16, 2005 |

| Bookkeeping Regulations | RR V-1 | March 17, 1947 |

| Consolidated Registration | RR 7-2012 | |

| Preserving Books of Accounts | RR 17-2013 | |

| Mandatory Filing eBIRforms | RR 6-2014 | |

| Due Process in Assessment | RR 12-1999 | |

| Ordinary vs Capital Assets | RR 17-2003 |

FUNDAMENTALS OF INCOME TAXATION

Title II, Tax On Income, NIRC

RR 2-40 dtd Feb 10, 1940 (Mother RR)

RR 8-2018 dtd Feb 20, 2018 (TRAIN Law)

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.

Tax on a person's income, emoluments, profits arising from property, practice of profession, conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 (Tax Code), as amended, less the deductions if any, authorized for such types of income, by the Tax Code, as amended, or other special laws.

The three elements in the imposition of income tax are:

- there must be gain or and profit,

- that the gain or profit is realized or received, actually or constructively, and

- it is not exempted by law or treaty from income tax.

G.R. 108576

Source: https://lawphil.net/judjuris/juri1999/jan1999/gr_108576_1999.html

Within the Philippines

- Located inside the Philippine Archipelago

Without the Philippines

- Located outside the Philippine Archipelago

Citizenship principle

- For Filipino citizens and domestic corporations, who are entitled to Philippine government protection wherever they are situated.

Residence principle

- For alien individuals and foreign corporations

Source principle

- For alien individuals and foreign corporations

The situs of income is the place of taxation of income. It is the jurisdiction that has the authority to impose tax upon the income.

| Particulars | Situs |

|---|---|

| Interests | Residence of Debtor |

| Dividends | Residents of the Corporation paying dividend |

| Services | Place of performance of the service |

| Rentals and Royalties | Location of the property or interest in such property |

| Sale of Real Property | Location of Real Property |

| Sale of Personal Property | in the country in which sold |

- Income from Compensation

- Income form Business / Profession

- Income which are Passive

- Income which are exempt

- Income from sales of Assets

- Ordinary asset or capital asset

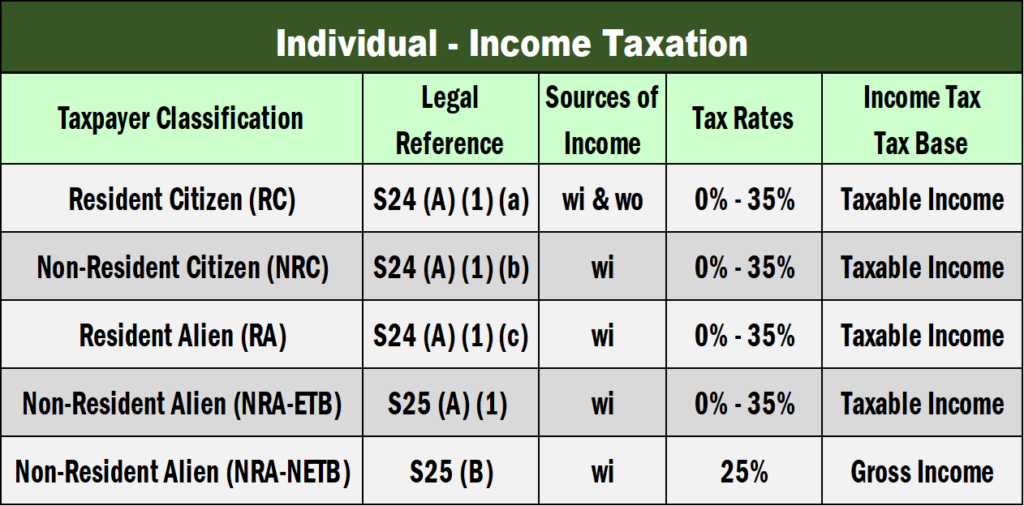

INDIVIDUAL TAXPAYERS

- Resident

- Citizen / Estate / Trust

- Alien

- Non-Resident

- Citizen

- Alien

- Engaged in Trade or Business

- Not-Engaged in Trade or Business

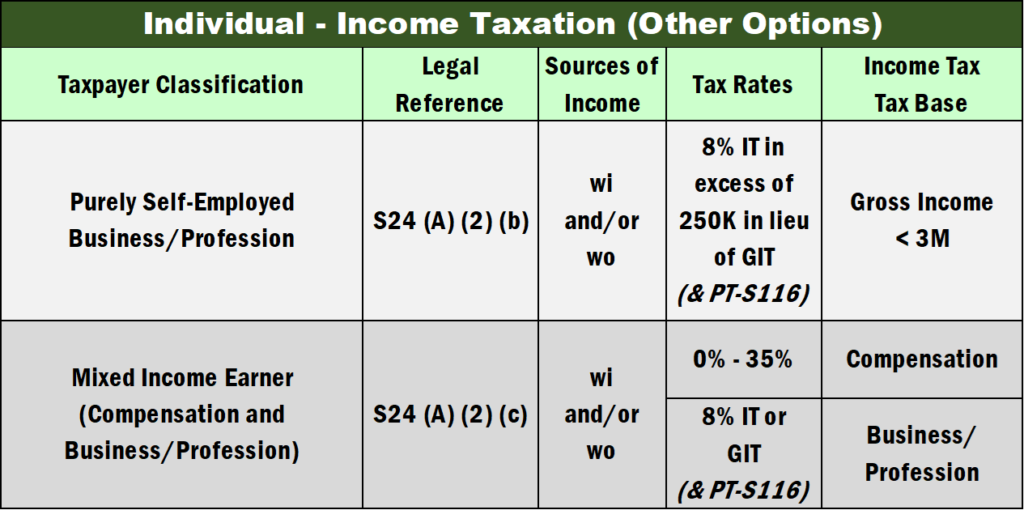

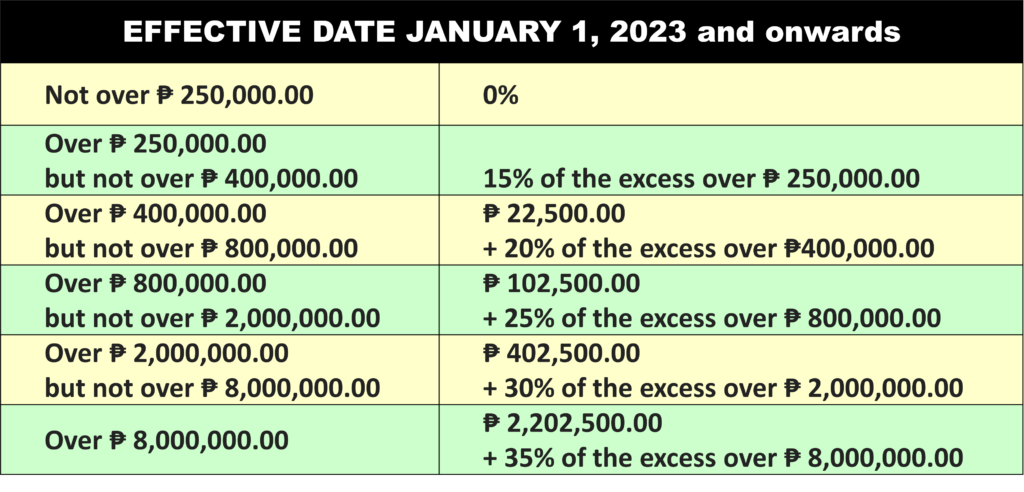

- Graduated income tax on individuals and 8% IT option

- Capital gains tax of an individual on sale or exchange of shares of stocks classified as capital assets.

- Capital gains tax on sale or exchange of real properties classified as capital assets

- Final Tax on certain passive income paid to residents

- Final Tax income of Non-Resident aliens

- Final Tax on special individuals

- Fringe benefit tax on fringe benefits of supervisors and managers payable by employer.

NRC – Non-Resident Citizen

Period of stay of contract worker abroad is 183 days or more

NRAETB – Non-Resident Alien Engaged in Trade or Business

Period of stay in the Philippines during any taxable year exceeds 180 days

NRANETB – Non-Resident Alien NOT Engaged in Trade or Business

Period of stay in the Philippines during any taxable year does not exceed 180 days

Income Tax Rate Options for Individual Taxpayer

- 8% Income Tax option

- Based on Gross Income

- Graduated Income Tax option - based on a Graduated Income Tax Table

- Optional Standard Deduction

- Allowed Itemized Deduction

Graduated Income Tax Table

NON-INDIVIDUAL TAXPAYERS

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.

INCOME, GROSS INCOME AND TAXABLE INCOME

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.

ALLOWABLE DEDUCTIONS

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.

CONDITIONS AND LIMITATIONS ON DEDUCTIBILITY

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.

CONCEPTS OF INCOME TAX

NATIONAL INTERNAL REVENUE CODE

xxx

TITLE II INCOME TAX

xxx

CHAPTER II GENERAL PRINCIPLES

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines.