RA 11976 Ease of Paying Taxes (EOPT) Law Highlights

Tax Alert!

Ease of Paying Taxes (EOPT) Law BIR issuances:

RMC 3-2024 Circularizes RA No. 11976 (Ease of Paying Taxes Act) and the Veto Message of President Ferdinand R. Marcos Jr

RMC 3-2024 Annex A – copy of RA 11976

RMC 3-2024 Annex B – copy of vetoed message

RA 11976 was signed into law on January 5, 2024.

Effectivity : within 15 days upon publication in official gazette or general publication (published January 7, 2024) — thus, making January 22, 2024 as effectivity date.

Following are the EOPT Highlights (as summarized by ptabcp.com and easantoscpa.com):

The EOPT law classifies taxpayers into micro, small, medium, and large according to their gross sales in order to form a tax system that is responsive and specific to each segment’s needs.

=======

SEC. 21. Sources of Revenue and Classification of Taxpayers. –: [115]

(A) The following taxes, fees and charges are deemed to be national internal revenue taxes:

(1) Income tax;

(2) Estate and donor’s taxes;

(3) Value-added tax;

(4) Other percentage taxes;

(5) Excise taxes;

(6) Documentary stamp taxes; and

(7) Such other taxes as are or hereafter may be imposed and collected by the Bureau of Internal Revenue.

(B) Classification of Taxpayers. – for purposes of responsive tax administration, taxpayers shall be classified as follows:

| GROUP | GROSS SALES |

| MICRO | LESS THAN THREE MILLION PESOS (P3,000,000) |

| SMALL | THREE MILLION PESOS (P3,000,000) TO LESS THAN TWENTY MILLION PESOS (P20,000,000) |

| MEDIUM | TWENTY MILLION PESOS (P20,000,000) TO LESS THAN ONE BILLION PESOS (P1,000,000,000) |

| LARGE | ONE BILLION PESOS (P1,000,000,000) AND ABOVE |

EOPT Law repealed and deleted the provisions for Annual Registration Fee effective January 22, 2024

Additional Readings:

Under EOPT Law, FILE Tax Returns (BIR Forms) and PAY internal revenue taxes through electronic or manual means at any authorized agent banks (AABs), RDO through the Revenue Collection Officer (RCO), or authorized software providers.

The option to pay internal revenue taxes to the city or municipal treasurer with jurisdiction over the taxpayer was removed in order to encourage the shift to electronic payment channels.

In relation, this eliminates the 25% surcharge on wrong-venue filings.

Furthermore, it ensures the availability of registration facilities to taxpayers not residing in the country.

=====

Affected Tax Code provisions:

=====

SEC. 51. Individual Return. -

(A) Requirements. -

xxx

(B) Where to File. - Except in cases where the Commissioner otherwise permits, the return shall be filed with any authorized agent bank, Revenue District Officer, through Revenue Collection Officer, or authorized Tax Software provider.

=====

SEC. 58. Returns and Payment of Taxes Withheld at Source. -

(A) Quarterly Returns and Payments of Taxes Withheld. - Taxes deducted and withheld under Section 57 by withholding agents shall be covered by a return and paid to, either electronically or manually, except in cases where the Commissioner otherwise permits, any authorized agent bank, Revenue District Officer, Collection Officer, or authorized tax software provider.

====

SEC. 77. Place and Time of Filing and Payment of Quarterly Corporate Income Tax. -

(A) Place of Filing. - Except as the Commissioner otherwise permits, the quarterly income tax declaration required in Section 75 and the final adjustment return required in Section 76 shall be filed, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

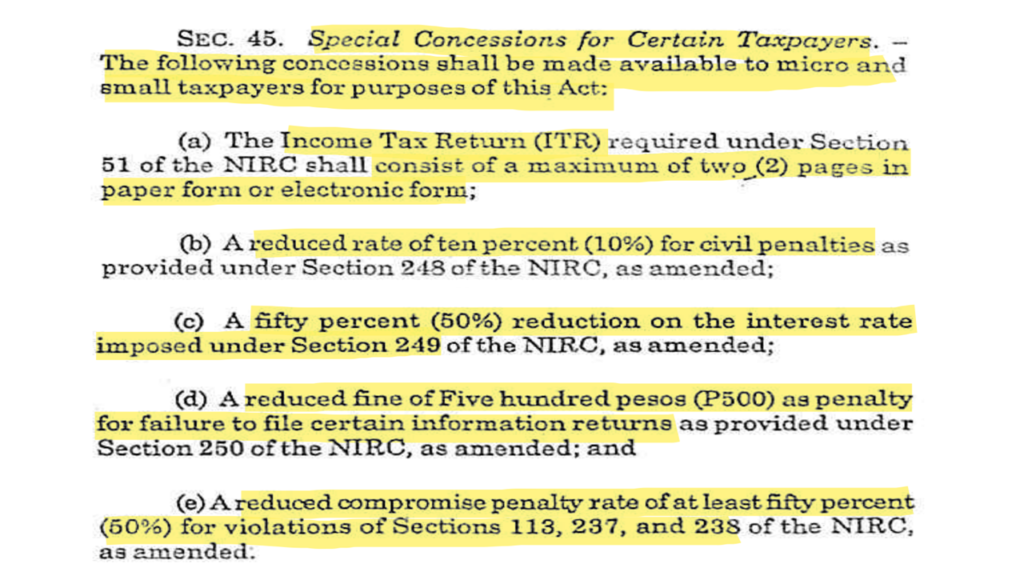

(B) Time of Filing the Income Tax Return. - The corporate quarterly declaration shall be filed, either electronically or manually, within sixty (60) days following the close of each of the first three (3) quarters of the taxable year. The final adjustment return shall be filed on or before the fifteenth (15th) day of April, or on or before the fifteenth (15th) day of the fourth (4th) month following the close of the fiscal year, as the case may be.

(C) Time of Payment of the Income Tax. - The income tax due on the corporate quarterly returns and the final adjustment income tax returns computed in accordance with Sections 75 and 76 shall be paid, either electronically or manually, at the time the declaration or return is filed in a manner prescribed by the Commissioner.

=====

CHAPTER XIII

WITHHOLDING ON WAGES

xxx

SEC. 81. Filing of Return and Payment of Taxes Withheld. - Except as the Commissioner otherwise permits, taxes deducted and withheld by the employer on wages of employees shall be covered by a return and paid, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

The return shall be filed and the payment made, either electronically or manually, within twenty-five (25) days from the close of each calendar quarter: Provided, however, That the Commissioner may, with the approval of the Secretary of Finance, require the employers to pay or deposit the taxes deducted and withheld at more frequent intervals, in cases where such requirement is deemed necessary to protect the interest of the Government.

The taxes deducted and withheld by employers shall be held in a special fund in trust for the Government until the same are paid to the said collecting officers.

=====

TITLE III

ESTATE AND DONOR’S TAXES

CHAPTER I

ESTATE TAX

xxx

SEC. 90. Estate Tax Returns.

xxx

(D) Place of Filing. - Except in cases where the Commissioner otherwise permits, the return required under Subsection (A) shall be filed, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

SEC. 91. Payment of Tax.

(A) Time of Payment. - The estate tax imposed by Section 84 shall be paid, either electronically or manually, at the time the return is filed by the executor, administrator or the heirs.

xxx

(D) Liability for Payment - The estate tax imposed by Section 84 shall be paid, either electronically or manually, by the executor or administrator before delivery to any beneficiary of his distributive share of the estate. Such beneficiary shall to the extent of his distributive share of the estate, be subsidiarily liable for the payment of such portion of the estate tax as his distributive share bears to the value of the total net estate.

xxx

CHAPTER II

DONOR'S TAX

xxx

SEC. 103. Filing of Return and Payment of Tax.

xxx

(B)Time and Place of Filing and Payment -The return of the donor required in this Section shall be filed, either electronically or manually, within thirty (30) days after the date the gift is made and the tax due thereon shall be paid, either electronically or manually, at the time of filing. Except in cases where the Commissioner otherwise permits, the return shall be filed and the tax paid, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

=====

TITLE IV

VALUE ADDED TAX

xxx

CHAPTER II

COMPLIANCE REQUIREMENTS

xxx

SEC. 114. Return and Payment of Value-Added Tax

(A) In General. [4] - Every person liable to pay the value-added tax imposed under this Title shall file, either electronically or manually, a quarterly return of the amount of his gross sales within twenty-five (25) days following the close of each taxable quarter prescribed for each taxpayer: Provided, however, That VAT-registered persons shall pay, either electronically or manually, the value-added tax on a monthly basis: Provided, finally, That beginning January 1, 2023, the filing and payment required under this Subsection shall be done within twenty-five (25) days following the close of each taxable quarter. [113]

Any person, whose registration has been cancelled in accordance with Section 236, shall file a return and pay the tax due thereon within twenty-five (25) days from the date of cancellation of registration: Provided, That only one consolidated return shall be filed by the taxpayer for his principal place of business or head office and all branches.

(B) Where to File the Return and Pay the Tax. - Except as the Commissioner otherwise permits, the return shall be filed with and the tax paid, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

=====

TITLE V

OTHER PERCENTAGE TAXES

SEC. 116. Tax on Persons Exempt from Value-Added Tax (VAT). - Any person whose sales are exempt under Section 109(CC) of this Code from the payment of value-added tax and who is not a VAT-registered person shall pay, either electronically or manually, a tax equivalent to three percent (3%) of his gross quarterly sales: Provided, That cooperatives, shall be exempt from the three percent (3%) tax herein imposed: Provided, further, That effective July 1, 2020 until June 30, 2023, the rate shall be one percent (1%).

xxx

SEC. 128. Returns and Payment of Percentage Taxes

(A) Returns of Gross Sales or Earnings and Payment of Tax. -

(1) Persons Liable to Pay Percentage Taxes. - Every person subject to the percentage taxes imposed under this Title shall file, either electronically or manually, a quarterly return of the amount of the person's gross sales or earnings and pay, either electronically or manually, with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider, the tax due thereon within twenty-five (25) days after the end of each taxable quarter: Provided, That in the case of a person whose VAT registration is cancelled and who becomes liable to the tax imposed in Section 116 of this Code, the tax shall accrue from the date of cancellation and shall be paid in accordance with the provisions of this Section.

(2) Person Retiring from Business. - Any person retiring from a business subject to percentage tax shall notify the nearest internal revenue officer, file, either electronically or manually, the person's return and pay, either electronically or manually, the tax due thereon within twenty (20) days after closing the business.

xxx

(B) Where to File. - Except as the Commissioner otherwise permits, every person liable to the percentage tax under this Title shall file, either electronically or manually, a consolidated return for all branches or places of business with any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider..

=====

TITLE VII

DOCUMENTARY STAMP TAX

xxx

SEC. 200. Payment of Documentary Stamp Tax.

(A) In General.- The provisions of Presidential Decree No. 1045 notwithstanding, any person liable to pay documentary stamp tax upon any document subject to tax under Title VII of this Code shall file a tax return, either electronically or manually, and pay, either electronically or manually, the tax in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner.

(B) Time for Filing and Payment of the Tax. - Except as provided by rules and regulations promulgated by the Secretary of Finance, upon recommendation of the Commissioner, the tax return prescribed in this Section shall be filed, either electronically or manually, within ten (10) days after the close of the month when the taxable document was made, signed, issued, accepted, or transferred, and the tax thereon shall be paid, either electronically or manually, at the same time the aforesaid return is filed.

(C) Where to File.- Except in cases where the Commissioner otherwise permits, the aforesaid tax return shall be filed, either electronically or manually, with and the tax due shall be paid, either electronically or manually, through any authorized agent bank, Revenue District Office through Revenue Collection Officer or authorized tax software provider.

=====

TITLE IX

COMPLIANCE REQUIREMENTS

xxx

CHAPTER II

ADMINISTRATIVE PROVISIONS

xxx

(B) Registration of Each Type of Internal Revenue Tax.- Every person who is required to register with the Bureau of Internal Revenue under Subsection (A) hereof, shall register each type of internal revenue tax for which he is obligated, shall file a return, either electronically or manually, and shall pay, either electronically or manually, such taxes, and shall update such registration of any changes in accordance with Subsection (D) hereof.

(C) Transfer of Registration. - In case a registered person decides to transfer the place of business or head office or branches, it shall be the person's duty to update the registration status by merely filing, either electronically or manually, an application for registration information update in the form prescribed therefor: Provided, however, That if the transferring registered person is subject of an audit investigation, the Revenue District Office which initiated the audit investigation shall continue the same.

xxx

(E) Cancellation of Registration. –

(1) General Rule. - The registration of any person shall be cancelled upon mere filing, either electronically or manually, with the Revenue District Office where he is registered an application for registration information update in a form prescribed therefor. However, this shall not preclude the Commissioner of the Internal Revenue or his authorized representative from conducting an audit in order to determine any tax liability;

xxx

(F) Persons Required to Register for Value-Added Tax. —

xxx

2) Every person who becomes liable to be registered under paragraph (1) of this Subsection shall register, either electronically or manually, with the appropriate Revenue District Office, as determined by the Commissioner. If he fails to register, he shall be liable to pay the tax under Title IV as if he were a VAT-registered person, but without the benefit of input tax credits for the period in which he was not properly registered.

xxx

(G) Optional Registration for Value-Added Tax of Exempt Person.

(1) Any person who is not required to register for value-added tax under Subsection (F) hereof may elect to register, either electronically or manually, for value-added tax with the Revenue District Office that has a jurisdiction over the head office of that person.

xxx

(H) Supplying of Taxpayer Identification Number. –

Any person required under the authority of this Code to make, render or file a return, statement or other document shall be supplied with or assigned a Taxpayer Identification Number which the person shall indicate in such return, statement or document filed, either electronically or manually, with the Bureau of Internal Revenue for his proper identification for tax purposes, and which the person shall indicate in certain documents, such as, but not limited to the following:

xxx

EOPT Law includes the five-year period for preservation of books of account

Note that this does not remove the requirement to preserve the books of accounts for up to ten (10) years in cases of tax audit due to fraud.

Section 235, NIRC, as amended by EOPT Law shall now read as follows:

SEC. 235. Preservation of Books and Accounts and Other Accounting Records. - All the books of accounts, including the subsidiary books and other accounting records of corporations, partnerships, or persons, shall be preserved by them for a period of five (5) years reckoned from the day following the deadline in filing a return, or if filed after the deadline, from the date of the filing of the return, for the taxable year when the last entry was made in the books of accounts. The said books and records shall be subject to examination and inspection by internal revenue officers: Provided, That for income tax purposes, such examination and inspection shall be made only once in a taxable year, except in the following cases:

(a) Fraud, irregularity or mistakes, as determined by the Commissioner;

(b) The taxpayer requests reinvestigation;

(c) Verification of compliance with withholding tax laws and regulations;

(d) Verification of capital gains tax liabilities; and

(e) In the exercise of the Commissioner's power under Section 5(B) to obtain information from other persons in which case, another or separate examination and inspection may be made. Examination and inspection of books of accounts and other accounting records shall be done in the taxpayer's office or place of business or in the office of the Bureau of Internal Revenue. All corporations, partnerships or persons that retire from business shall, within ten (10) days from the date of retirement or within such period of time as may be allowed by the Commissioner in special cases, submit their books of accounts, including the subsidiary books and other accounting records to the Commissioner or any of his deputies for examination, after which they shall be returned. Corporations and partnerships contemplating dissolution must notify the Commissioner and shall not be dissolved until cleared of any tax liability.

Any provision of existing general or special law to the contrary notwithstanding, the books of accounts and other pertinent records of tax-exempt organizations or grantees of tax incentives shall be subject to examination by the Bureau of Internal Revenue for purposes of ascertaining compliance with the conditions under which they have been granted tax exemptions or tax incentives, and their tax liability, if any.

No more issuance of Official Receipt on the sale of services.

EOPT law also harmonizes the rules on the value-added tax (VAT) treatment of sales of goods and services, thereby requiring sales invoice for both.

SEC. 113. Invoicing and Accounting Requirements for VAT-Registered Persons. -

(A) Invoicing Requirements. - A VAT-registered person shall issue a VAT invoice for every sale, barter, exchange, or lease of goods or properties and for every sale, barter or exchange of services.

With these updates, VAT is due upon issuance of the invoice, regardless of the timing of collection.

This may hurt the Taxpayer's Cash flow, as such, EOPT Law provided a Remedy:

Section 110 (D), NIRC as amended by EOPT Law:

(D) Output VAT credit on uncollected receivables. – a seller of goods or services may deduct the output VAT pertaining to uncollected receivables from its output VAT on the next quarter, after the lapse of the agreed upon period to pay: provided, that the seller has fully paid the VAT on the transaction: provided, further, that the VAT component of the uncollected receivables has not been claimed as allowable deduction under section 34(e) of this Code.

In case of recovery of uncollected receivables, the output VAT pertaining thereto shall be added to the output VAT of the taxpayer during the period of recovery.”

For purposes of this section, the term “gross sales” means the total amount of money or its equivalent representing the contract price, compensation, service fee, rental or royalty, including the amount charged for materials supplied with the services and deposits and advanced payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person, which the purchaser pays or is obligated to pay to the seller in consideration of the sale, barter, or exchange of services that has already been rendered by the seller and the use or lease of properties that have already been supplied by the seller, excluding value-added tax and those amounts earmarked for payment to third (3rd) party or received as reimbursement for payment on behalf of another which do not redound to the benefit of the seller as provided under relevant laws, rules or regulations: Provided, That for long-term contracts for a period of one (1) year or more, the invoice shall be issued on the month in which the service, or use or lease of properties is rendered or supplied.

On the invoicing requirements, the need to specify the business style has been removed. Further, an invoice with incomplete information is no longer a bar to claim input VAT provided the lacking information is not one of the essential ones, specifically the sales amount, VAT amount, name and taxpayer identification number (TIN) of buyer and seller and description and date of the transaction.

=======

SEC. 113. Invoicing and Accounting Requirements for VAT-Registered Persons

xxx

(B) Information Contained in the VAT Invoice. - The following information shall be indicated in the VAT invoice:

(1) A statement that the seller is a VAT-registered person, followed by the seller's Taxpayer's Identification Number;

(2) The total amount which the purchaser pays or is obligated to pay to the seller with the indication that such amount includes the value-added tax: Provided, That:

(a) The amount of the tax shall be shown as a separate item in the invoice;

(b) If the sale is exempt from value-added tax, the term VAT-exempt sale shall be written or printed on the invoice;

(c) If the sale is subject to zero percent (0%) value-added tax, the term 'zero-rated sale' shall be written or printed on the invoice.

(d) If the sale involves goods, properties or services some of which are subject to and some of which are VAT zero-rated or VAT exempt, the invoice shall clearly indicate the break-down of the sale price between its taxable, exempt and zero-rated components, and the calculation of the value-added tax on each portion of the sale shall be shown on the invoice: Provided, That the seller may issue separate invoices for the taxable, exempt, and zero-rated components of the sale.

(3) The date of transaction, quantity, unit cost and description of the goods or properties or nature of the service; and

(4) In the case of sales in the amount of One thousand pesos (P1,000) or more where the sale or transfer is made to a VAT-registered person, the name, address and Taxpayer Identification Number of the purchaser, customer or client. [112]

The mandatory issuance of receipts for each sale and transfer of goods and services increased from PHP 100 to PHP 500.

====

SEC. 237. Issuance of Sales or Commercial Invoices. –

(A) Issuance. - All persons subject to an internal revenue tax shall, at the point of each sale and transfer of merchandise or for services rendered valued at Five hundred pesos (Php500.00) or more, issue duly registered sale or commercial invoices, showing the name, Taxpayer Identification Number, date of transaction, quantity, unit cost and description of merchandise or nature of service: Provided, That the amount herein stated shall be adjusted to its present values every three (3) years using the consumer price index, as published by the Philippine Statistics Authority: Provided, further, That the seller shall issue sale or commercial invoices when the buyer so requires regardless of the amount of transaction: Provided, however, That if the sales amount per transaction is below the threshold, the seller will issue one (1) invoice for the aggregate sales amount for such sales at the end of the day: Provided, further, That the aggregate sales amount at the end of the day is at least Five hundred pesos (Php500.00): Provided, finally, That VAT-registered persons shall issue duly registered sale or commercial invoices regardless of the amount of the sale and transfer of merchandise or for services rendered.”

Within five(5) years from the effectivity of this Act and upon the establishment of a system capable of storing and processing the required data, the Bureau shall require taxpayers engaged in the export of goods and services, taxpayers engaged in e-commerce, and taxpayers under the jurisdiction of the Large Taxpayers Service to issue electronic receipts or sales or commercial invoices in lieu of manual receipts or sales or commercial invoices, subject to the rules and regulations to be issued by the Secretary of Finance upon recommendation of the Commissioner and after a public hearing shall have been held for this purpose: Provided, That taxpayers not covered by the mandate of this provision may issue electronic receipts or sales or commercial invoices, in lieu of manual receipts, and sales and commercial invoices.

The original of each receipt or invoice shall be issued to the purchaser, customer or client at the time the transaction is effected, who, if engaged in business or in the exercise of profession, shall keep and preserve the same in his place of business for a period of three (3) years from the close of the taxable year in which such invoice or receipt was issued, while the duplicate shall be kept and preserved by the issuer, also in his place of business, for a like period: Provided, That in case of electronic receipts or sales or commercial invoices, the digital records of the same shall be kept by the purchaser, customer or client and the issuer for the same period above stated.

The Commissioner may, in meritorious cases, exempt any person subject to internal revenue tax from compliance with the provisions of this Section.

The EOPT law, repealed Section 34(K) of the Tax Code on the requirement to withhold taxes as a requisite to claim deductions from gross income.

(K) Additional Requirements for Deductibility of Certain Payments - Repealed.

====

Prior to EOPT Law, withholding tax rules--whichever comes first rule: the obligation to withhold arises at the time an income payment is paid, becomes payable, or is accrued or recorded as an expense or asset, whichever is applicable in the payor’s books, whichever comes first. (Under EOPT Law, this will no longer apply)

However, under the EOPT Law, the timing of withholding of tax has been simplified with the introduction of a new provision under the Tax Code [Section 58 (C)] which states that the obligation to deduct and withhold tax arises at the time the income has become payable.

Sec.58 (C), NIRC, as amended. Timing of Withholding Taxes. – the obligation to deduct and withhold the tax arises at the time the income has become payable.

=====

The President, however, vetoed Section 8 of the Act which exempts micro taxpayers from withholding creditable income tax citing possible understatement of tax obligations that would impact on the government’s cash flows.

Creditable withholding taxes serve as advance payment of tax obligations and an audit trail for compliance.

“We have to strike a balance between providing relief to taxpayers, on the one hand, and maintaining administrative efficiency through the integrity of our tax collection and monitoring mechanisms, on the other,” the President explained.

Source: DOF

The VAT refunds are classified into low-, medium-, and high-risk claims which are based on the amount of VAT refund claim, tax compliance history, and frequency of filing of VAT refund claims, among others.

Moreover, an invoice system will be implemented to accelerate VAT refunds.

The Act now also provides a 180-day period for the Bureau of Internal Revenue (BIR) to process general refund claims on erroneous or illegally collected taxes.

=====

SEC. 112. Refunds of Input Tax. -

(A) Zero-rated or Effectively Zero-rated Sales. - Any VAT-registered person, whose sales are zero-rated or effectively zero-rated may, within two (2) years after the close of the taxable quarter when the sales were made, apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales, except transitional input tax, to the extent that such input tax has not been applied against output tax: Provided, however, That in the case of zero-rated sales under Section 106(A)(2)(a)(1), (2) and (b) and Section 108 (B)(1) and (2), the acceptable foreign currency exchange proceeds thereof had been duly accounted for in accordance with the rules and regulations of the Bangko Sentral ng Pilipinas (BSP): Provided, further, That where the taxpayer is engaged in zero-rated or effectively zero-rated sale and also in taxable or exempt sale of goods of properties or services, and the amount of creditable input tax due or paid cannot be directly and entirely attributed to any one of the transactions, it shall be allocated proportionately on the basis of the volume of sales. Provided, finally, That for a person making sales that are zero-rated under Section 108(B) (6), the input taxes shall be allocated ratably between his zero-rated and non-zero-rated sales.

(B) Cancellation of VAT Registration. - A person whose registration has been cancelled due to retirement from or cessation of business, or due to changes in or cessation of status under Section 106(C) of this Code may, within two (2) years from the date of cancellation, apply for the issuance of a tax credit certificate or cash refund for any unused input tax which may be used in payment of his other internal revenue taxes or apply for refund for any unused input tax.

(C) Period within which Refund of Input Taxes shall be Made. - In proper cases, the Commissioner shall grant a refund for creditable input taxes within ninety (90) days from the date of submission of invoices and other documents in support of the application filed in accordance with Subsections (A) and (B) hereof: Provided, That for this purpose, the VAT refund claims shall be classified into low-, medium-, and high-risk claims, with the risk classification based on amount of VAT refund claim, tax compliance history, frequency of filing VAT refund claims, among others: Provided, further, that medium- and high-risk claims shall be subject to audit or other verification processes in accordance with the Bureau of Internal Revenue's national audit program for the relevant year: Provided, finally, That should the Commissioner find that the grant of refund is not proper, the Commissioner must state in writing the legal and factual basis for the denial within the ninety (90)-day period.

In case of full or partial denial of the claim for tax refund, or the failure on the part of the Commissioner to act on the application within the period prescribed above, the taxpayer affected may, within thirty (30) days from the receipt of the decision denying the claim, or after the expiration of the ninety (90)-day period, appeal the decision with the Court of Tax Appeals: Provided, however, That failure on the part of any official, agent, or employee of the Bureau of Internal Revenue to act on the application within ninety (90) days period shall be punishable under Section 269 of this Code.

(D) Manner of Giving Refund. - Refunds shall be made upon warrants drawn by the Commissioner or by his duly authorized representative without the necessity of being countersigned by the Chairman, Commission on Audit, the provisions of the Administrative Code of 1987 to the contrary notwithstanding: Provided, That refunds under this paragraph shall be subject to post audit by the Commission on Audit following the risk-based classification above-described: Provided, further, That in case of disallowance by the commission on audit, only the taxpayer shall be liable for the disallowed amount without prejudice to any administrative liability on the part of any employee of the Bureau of Internal Revenue who may be found to be grossly negligent in the grant of refund.”.

(B) Time for Filing and Payment of the Tax. - Except as provided by rules and regulations promulgated by the Secretary of Finance, upon recommendation of the Commissioner, the tax return prescribed in this Section shall be filed, either electronically or manually, within ten (10) days after the close of the month when the taxable document was made, signed, issued, accepted, or transferred, and the tax thereon shall be paid, either electronically or manually, at the same time the aforesaid return is filed.

The Ease of Paying Taxes and Digitalization Roadmap will be developed by the BIR to promote and assist taxpayers by streamlining tax processes, reducing documentary requirements, and digitalizing its services.

Examples are ORUS and Accreditation of Software Providers

Disclaimer:

Articles and/or Lectures presented here are only for conceptual guidance and not as expression or substitute for expert opinion. Please consult professionals or consultants re your concerns.